Open Banking now available on your BpH Wealth Personal Finance Portal

BpH Wealth is pleased to say that we now have Open Banking available to use in your Personal Finance Portal (PFP). With Open Banking, your PFP can become the place you go to view, manage and plan your finances. This document explains Open Banking, its features, and how to set it up if should you choose to do so.

What is Open Banking?

Open Banking is possible because of a new regulation from the Financial Conduct Authority (FCA) in response to Payment Services Directive 2. This new directive mandates bank account providers to share their clients’ account details with third party applications if you wish to request it.

With your permission, your PFP can be set up to display information from your bank account or accounts. Currently, current accounts, credit cards and some savings accounts from the following providers are available:

More account providers and account types are being added all the time.

With Open Banking your PFP can become the place where you view all your income, expenditure and balances of your bank accounts alongside the information from your portfolio already there.

Account balances and new transactions automatically upload and can be categorised, so that you can track how and where you spend as you spend. Graphs, filters and search functions are available, so that you can see spending patterns over different timeframes.

You can personalise how your data is used on the PFP. This can include:

- Re-categorising your transaction

- Setting up notifications of the categories you spend most on

- Receiving notifications when large transactions pass through your account

- Setting and tracking progress against monthly budgets for spending in categories.

Open Banking also means you can share your income and expenditure more easily with us without needing to spend lots of time collecting your data. This allows us to spend more time on the important things in meetings such as talking about your challenges, goals and aspirations. It also allows your advisor to get a better, more up-to date understanding of your income and outgoings, meaning we can come up with a more realistic idea of future income needs and therefore future retirement needs.

What about privacy?

Intelliflo Ltd, who provide the Open Banking service within your PFP, is regulated by the Financial Conduct Authority. You will always be in control of your data, permission is very explicitly given for the exact use of your data and consent must be renewed every 90 days. When you authenticate Open Banking, it is through your bank account provider. There is no sharing of passwords or security information with the PFP or Intelliflo.

Your BpH Wealth Adviser will only be able to see your top-line information from your bank accounts, such as your balance and spending, they will not be able to see any individual transactions.

You will be able to revoke access of the PFP to your accounts at any time. You can do this in your PFP account > Menu > Linked Accounts and clicking on the bin icon.

How Do I Set Up Open Banking in My Personal Finance Portal?

Setting up is easy and only takes a couple of minutes. First, log on to your PFP dashboard. Then click the menu button at the top right of the page.

Next, choose the ‘Linked Accounts’ option from the menu that appears.

If a popup appears, click ‘Get Started’ and you should arrive at a page with a ‘Link New Account’ button. Press this and you will arrive at a page with the list of currently available banks.

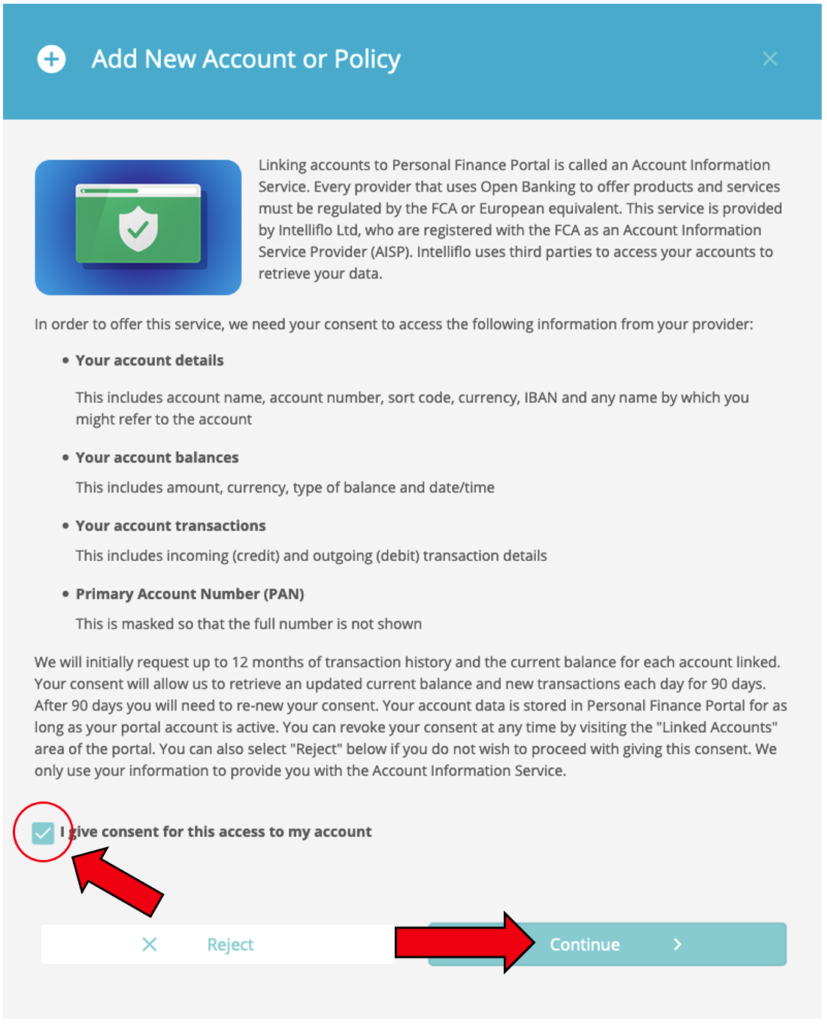

You will be presented with a list of banks that are currently available with online banking. Choose one and a popup will let you know the information that you are agreeing to share with your PFP, to let you know that Intelliflo (the service provider) is regulated by the Financial Conduct Authority and that you can stop access to your account details at any time. If you are still happy to proceed, click the box giving Intelliflo consent to access your account and then ‘Continue’.

You will then arrive at your bank’s page, where you can put in your personal account information. After this, you will be prompted to select which accounts to link. After that you should be set up.

If you have any questions you can visit the PFP user guide or please contact us.

Share this content