What kind of investments should I buy? (Investing For Beginners 5)

One thing I have not covered yet in this series is what investments you should actually buy. This will depend on your goals and preferences around volatility and risk. Each kind of investment has its own advantages and disadvantages. What works best for you is really for you to decide.

It is worth having another look at the chart I used in my first article of this series. It shows the risk and potential returns you can expect from each asset class when contemplating what investments to buy.

With these asset classes in mind, let’s look at some of the advantages and disadvantages of different investments.

Shares

Buying individual shares is a risky and challenging way to invest. However, it can generate some impressive returns. This is a good example of the relationship between risk and return I have discussed previously. When you buy shares in a company, you are making a bet that the company will do well, and its price will go up in the future. Whether a company’s share price will grow depends on a large range of factors. These include the wider economy and market sentiments, how a company is managed now and in the future, how a company’s competitors perform, and the impact of any new regulation. All of these factors range from hard to impossible to predict. Especially when investing for a number of years.

It is true that some shares can deliver very high returns. Recently large tech shares, known as FAANG stocks (Facebook, Amazon, Apple, Netflix and Alphabet/Google) have dominated financial news for the large returns they have generated over recent years. However, one of the most important rules in investing is that what has happened in the recent past cannot be expected to continue into the future.

Shares have to grow faster than the wider market to become the largest. However, once they are there, they tend to underperform. Research by Dimensional Fund Advisers showed that companies who joined the top 10 largest companies in the US outperformed the market by an average of 10% per year in the 10 years before they joined the top 10. However, after they reached the top 10, they underperformed the market by 1.5% per year for the next 10 years. This would suggest that while investing in the current largest shares like Apple and Amazon may have resulted in great returns in the past, it may not be a great decision now.

Picking winners?

Perhaps you may be thinking that instead of buying the current top companies, it would be better to try to predict the next Apple or Alphabet. The potential returns you could get from picking a future world leading company are very large indeed. However, seeing returns with the benefit of hindsight is one thing. Predicting which companies are going to perform well in the future is quite another.

Predicting which companies will succeed is hard work. Most successful companies have often had share prices which go nowhere or backwards for long periods of time before making it big. It is worth asking to yourself before investing in a share if you believe in the company so much that you would tolerate years of stagnant or negative returns. It may also be worth asking yourself if you should. Most companies will not end up being the next Microsoft. Holding on to the wrong stock too long could result in you losing your money.

Mutual Funds

‘Mutual fund’ is a broad term for a professionally managed investment products which pool money from many investors to buy many different assets. These funds can contain just one asset class or a mixture, such as shares, bonds, property and cash.

In theory, mixed asset funds should have reduced volatility compared to shares held in isolation. This is because different asset classes tend to behave differently under the same market conditions. For instance, when equities crash, the price of some bonds tends to go up. If you have both shares and bonds in a fund then an share price crash may be offset somewhat by an increase in the value of bonds.

However, there are many mixed asset funds out there that look great initially, but are riskier than they initially seem. For instance, some funds elect to use higher yield bonds to boost their returns in good times. However, higher yield bonds are more risky, and their price tends to fall when shares do. Therefore, having high yield bonds in your portfolio is not likely to shield you from much volatility in the case of market turmoil. If you are looking to manage risk it is worth looking up the correlation of returns of the different kinds of assets used in a fund you are thinking about buying.

One way an investing beginner can control for risk is to buy a mixture of single asset funds. Very simply, this may look like buying one or several equity funds with a percentage of your invested money, and buying low yield bond funds with the rest. This means you yourself can control how much of your money is working for growth and how much is there to help control for risk.

It is also important to note that some funds will be actively managed. These funds attempt to outperform the market (but rarely do). Other funds are passive, which look to match market returns. I explained this in more detail in a previous article.

Investing vs Speculation

Some people enjoy researching and picking shares they think will succeed. Others enjoy trading more frequently, buying and selling stocks to try to benefit from daily or weekly market movements. However, the less diversified your investments are, and the more frequently you trade, the more ‘investing’ becomes ‘speculation’ or effectively, gambling.

The more trading decisions you personally make, the more opportunity you have to get something wrong. As the future is impossible to predict, the odds are not in your favour. It is worth noting that less than a quarter of equity fund managers in Europe (leading experts in stock picking who often have teams of researchers behind them) have managed to outperform the wider European market over the last 5 years.

Owning funds which track the whole market rather than individual shares does remove the possibility of very large returns in short periods of time.However, it also essentially removes the risk that you will lose all your money. While markets do crash, they have always recovered and continued to grow throughout history. Individual shares within these markets, on the other hand, can significantly drop in value and never recover. They can even go to zero.

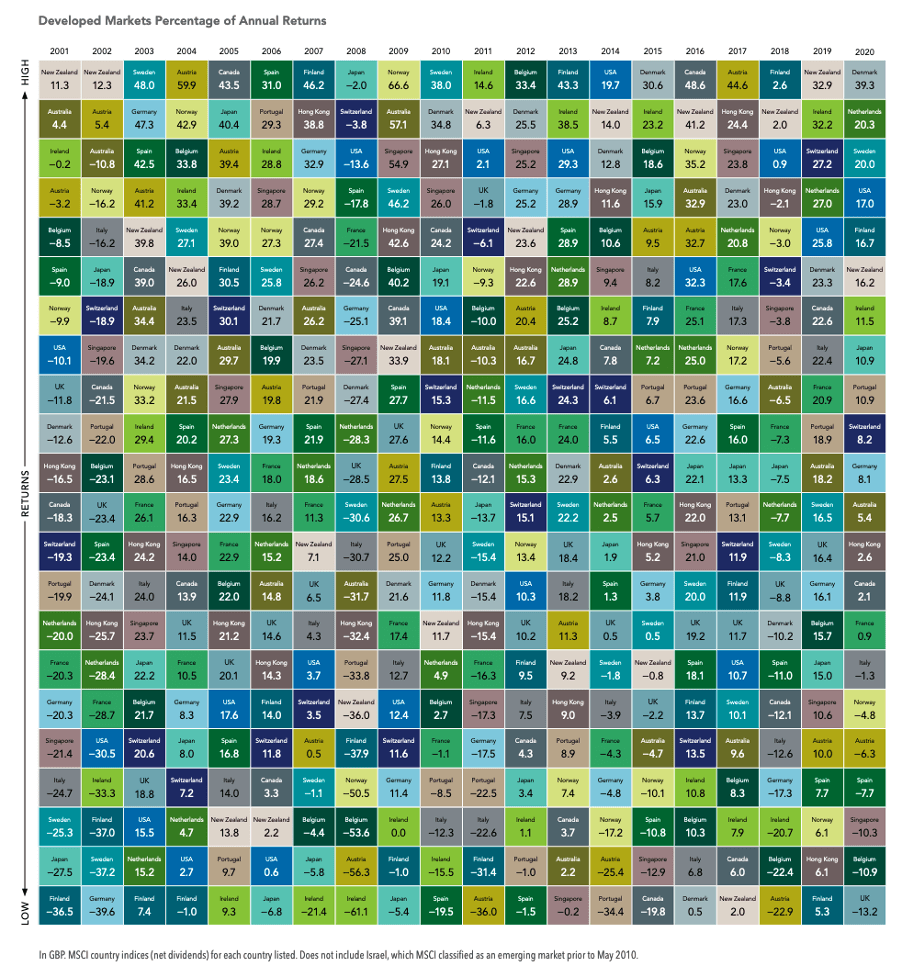

Historical evidence shows diversifying is the only way to improve your risk-adjusted returns over the long term. You can actually improve your returns by taking less risk. The chart below ranks the returns of developed countries markets from 2001-2020. As you can see, the position of each country changes wildly year by year. It is better to hold them all through a globally diversified fund and benefit from the average rather than only investing in one market or trying to guess which markets will come out on top.

Whenever you are investing, it is best to keep your goals in mind. Investing is not about making as much money as possible. It is about making your money work for you to help you reach to your financial goals in a sensible timeframe.

Research has shown that day traders experience exactly the same form of elation and dismay that you may feel in a casino. This is not a problem in itself, but it is not the same as having a robust investing strategy for your goals. If you are interested in this type of trading, it is sensible to allocate yourself a small allowance that you could afford to lose completely to sate this impulse. This should be thought of as separate from and alongside, not instead of, a more sensible investing strategy. Investing should not be emotive. It is a way to make your money work for you and allow you to meet your life goals.

Next Up

This article brings my investing for beginners series to a close. However, if you are still interested in learning more, then help is on the way. Follow me on LinkedIn or check back here to learn my top 10 tips for new investors, coming soon!

Risk Warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm. It does not represent a recommendation of any particular security, strategy, platform or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

This article was produced for educational purposes and aimed at UK residents.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Share this content