Market crises through a long-term lens

During good times in markets, headlines can cause investors to wonder whether such highs signal an impending downturn or poor future returns. However, history suggests that this fear, whilst common, is often misplaced.

Markets reaching an all-time high is not unusual, in fact it happens regularly. This is a reflection of investors being rewarded for taking on the risks of stock ownership, rather than a warning sign.

Since 1926, the US market has ended on a new high in about one out of every six weeks

Dimensional Fund Advisors[1]

This is not to say that markets will not decline; they do and can fall with disconcerting speed and magnitude. However, no one possesses the ability to consistently and accurately time the market. Attempting to predict when a high will turn into a decline is not only extremely difficult, getting it wrong can have significant implications for an investor’s financial plan.

Timing the market is not as simple as ‘buy low sell high’. There are two key decisions:

- When to sell; and

- When to buy back in.

Both come with material challenges.

Selling

Those who sell on a market peak or after a slight wobble have to contend with the fact that the market may continue to peak for many months or even years afterwards, potentially missing out on valuable growth. Further, buying back in later at more expensive prices may prove expensive by comparison. There is of course the worst-case scenario, in which the market stays defiantly high for so long the investor buys back in, only for the market to crash soon after.

Buying

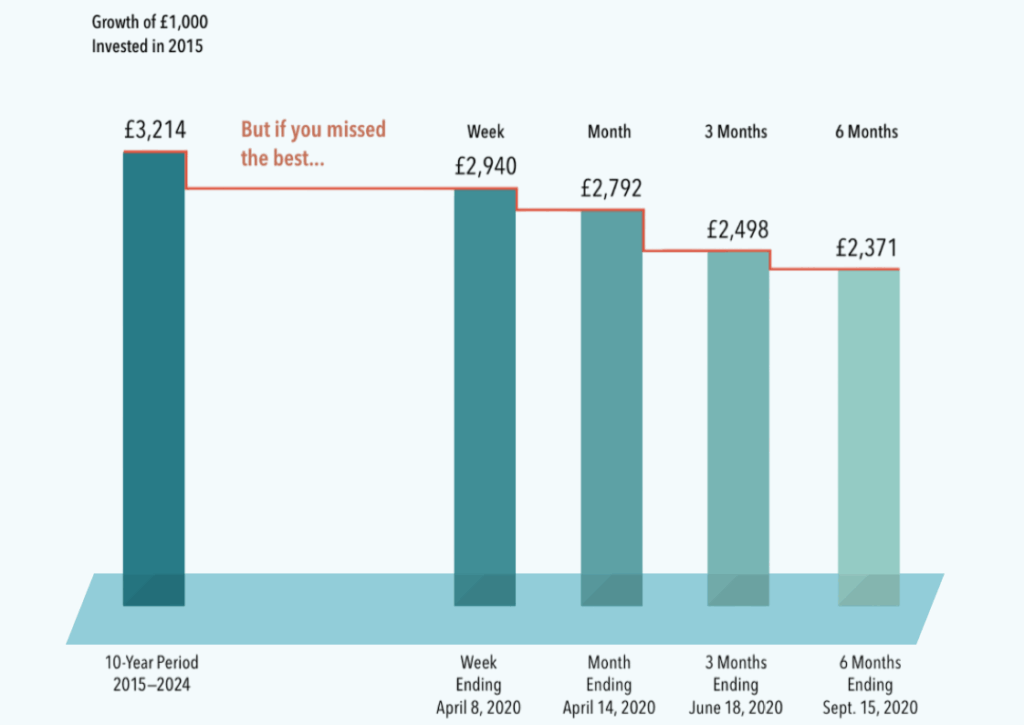

Some of the market’s best days happen when bouncing back after a crash, holding out for markets to hit the same lows again can be immensely costly if they never do. Further, crashes can happen in two or more waves, making it extremely difficult to find an optimal reentry point. The following chart considers missing the best days in the markets.

Source: Dimensional Fund Advisers

Either way, attempts to time the market are not investing, it is high-stakes gambling, it causes unnecessary stress and is no way to treat one’s hard-earned savings or to risk financial objectives. A solid financial plan is built using reams of historical data and analysis to give the investor the best chance of success in achieving their goals over the long term, it is not worth risking whether due to fear or to eke out extra returns.

Time in the Market, Not Timing the Market

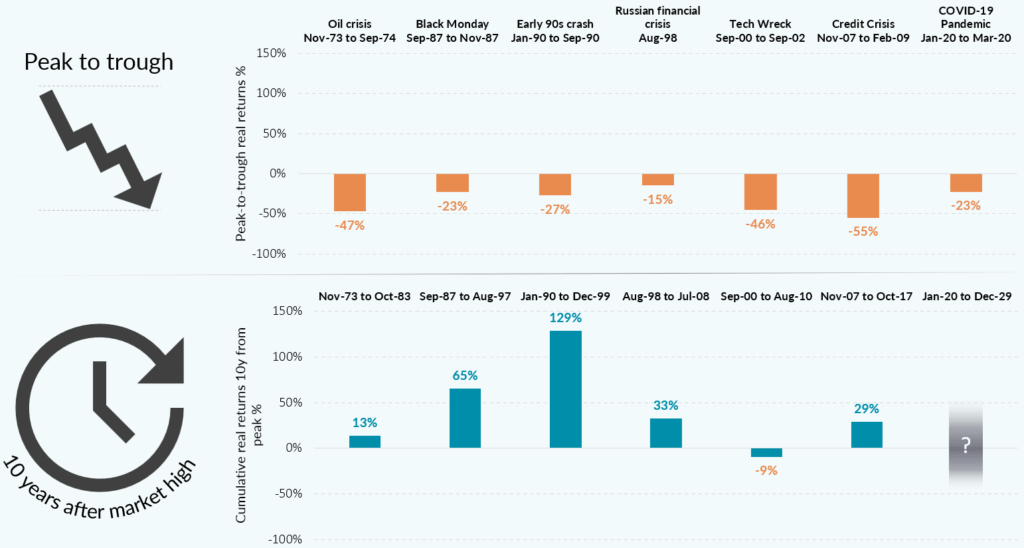

One tool investors possess to protect investments against declines is time. To provide context, the chart below illustrates seven major stock market crises over the past century, showing the performance from peak to trough and that – in most cases – ten years later portfolios had recovered and grown in real (inflation-adjusted) terms. The fact that not all periods show a positive outcome over the ten-year term illustrates the lack of any implicit guarantees, this risk is why investors are typically rewarded handsomely in the long run. This eventuality is also one reason that, in practicality, it is sensible for many investors to balance volatile stockholdings with other asset classes like bonds and property investments, which can even out the dips.

Figure 1: Market crises look different through a long-term lens

Source: Albion Strategic Consulting. Data source: Albion World Stock Market Index © https://smartersuccess.net/indices. In USD, after inflation.

Markets are inherently unpredictable. On any given day, they are roughly as likely to rise as they are to fall. Over five-year holding periods, returns of stock markets have fallen short of inflation 1-in-5 times[2] – a reminder of the risk that comes with investing.

However, the longer an investment is held, the greater the opportunity for expected outcomes to prevail. The investing journey comes with large steps forward and back – that is the nature of the game – but those that can look at investing through a long-term lens can cut through the headlines and take comfort that stock markets are doing the heavy lifting for them in the long run.

Important notes

This article is distributed for educational purposes for UK residents. It should not be considered investment advice, an offer of any security for sale nor a recommendation of any particular security, strategy, platform or investment product. This article contains the opinions of the author but not necessarily the Firm. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is no guide to future performance and investments can fall as well as rise.

[1] Dimensional Fund Advisors (August 2025), ‘The Informed Investor’ podcast, ep. 6

[2] Data source: Albion World Stock Market Index © https://smartersuccess.net/indices. In USD, after inflation. Jul-26 to Dec-24.

Share this content