Looking backwards and forwards for 2026

Being an investor is emotionally challenging, 2025 was certainly no exception. Even after a run of positive years, it is entirely natural to worry that some of those gains may be lost. Then again, this is regularly a feature of a long-term investor’s journey.

As the calendar turns, it is once again the season for bold predictions and outlooks both confident and dismal. Experience suggests that such forecasts are best treated lightly. The future, by definition, is unpredictable, the first few weeks of 2026 certainly exemplified this. A sensible forecast for the year ahead therefore remains unchanged: markets will go up, down or sideways.

Looking backwards

The past 12 months provided another vivid reminder of how quickly assumptions can be challenged and narratives rewritten.

Politically, 2025 was a year of unprecedented upheaval. The new US administration set about reshaping domestic and foreign policy with remarkable speed and ambition. Trade policy proved a powerful source of stock market volatility. Announcements of sweeping tariffs triggered sharp and sudden market reactions, only for many of those measures to be softened, delayed or diluted as practical realities intervened. Markets, as they often do, adjusted quickly to both the shock and the subsequent reassessment.

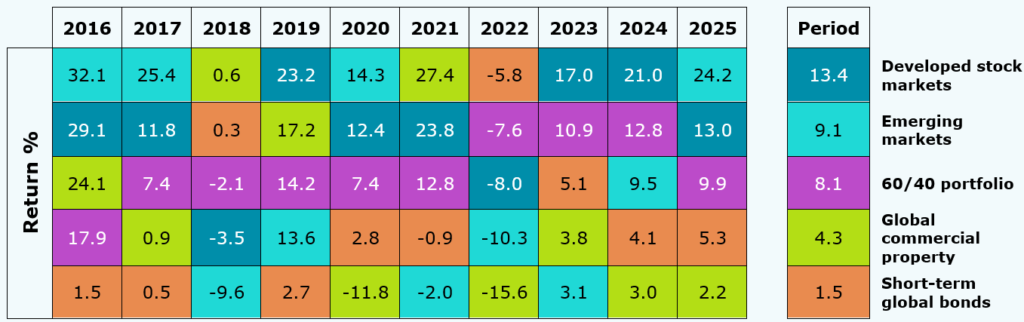

Stock markets rarely deliver returns close to their long‑term averages in any single year, this year was no exception. While it is always nice to see a raft of positive returns at the end of the year, long-term investor should treat them similarly to market falls, it’s the averages that are important.

Figure 1: 2025 market returns versus 10-year average

Source: Representative funds used. See endnote for details. In GBP terms.

Artificial intelligence (AI) dominated headlines throughout the year. Vast sums were committed to AI infrastructure, chip manufacturing and model development. Company valuations reached eye‑watering level, with Nvidia being the first company to reach a $5tn valuation. Yet confidence, at times, proved fragile. The emergence of intense competition amid doubts about long term profitability raised uncomfortable questions about competitive advantage and whether all that investment would ultimately yield a return.

Beyond markets and technology, the world remained unsettled. A fragile ceasefire in Gaza held for much of the latter part of the year, offering some respite but little in the way of lasting resolution. The war in Ukraine continued, grinding on with terrible human cost and little decisive movement. Elsewhere, conflict intensified in parts of Africa, while tensions escalated episodically across parts of Asia. Natural disasters added further strain, with devastating earthquakes, wildfires, and extreme weather events affecting millions.

The global economy however proved more resilient than many had feared. Growth endured, employment held up better than expected, and some central banks were able to begin cautiously easing monetary policy by lowering rates. Markets, overall, delivered another reminder that they are forward‑looking, adaptive and often more robust than the prevailing mood suggests.

2025 reinforced some long‑standing lessons. Concentration in fashionable themes can magnify both gains and losses. In a departure from recent years and despite the hype around US tech stocks, non-US developed market stocks fared better than their US counterparts. The MSCI World ex USA Index gained 22.8% when assessing returns in British pounds, outpacing the S&P 500 by the widest margin since 1993 and serving as a reminder of the potential benefits of a globally diversified portfolio. Emerging markets fared even better, with the MSCI Emerging Markets Index rising 24.4%. Worldwide equities, as measured by the MSCI All Country World Index, rose 13.9% for the year.

Broad diversification across regions, sectors and styles remains one of the few defences that does not rely on foresight. High‑quality, shorter‑dated bonds continued to play their role as stabilisers, reminding us that their value lies not in excitement but in reliability. Long term success lies in owning a broadly diversified, and well-structured, evidenced-based investment solution.

Figure 2: 10-year calendar year returns across markets and a diversified stock/bond portfolio

Source: Representative funds used. See endnote for details. In GBP terms.

Looking forwards

Entering 2026, uncertainty remains abundant. It always does.

Interest rates are generally lower than they were a year ago, but their future path is far from assured. Inflation has eased, but policy makers remain alert to the possibility of renewed pressures. Trade tensions, elections and geopolitical risks are ever‑present. None of this is new.

What is sometimes forgotten is that today’s prices already reflect today’s fears, hopes and expectations. Markets do not wait for events to happen; they move in anticipation of them. What will most likely matter in the year ahead are the surprises, not the scenarios that dominate current debate.

Acting on strong convictions about the near‑term direction of markets may feel comforting, but it carries the risk of being wrong twice: once when exiting, and again when deciding when to return.

A better way to cope with market volatility may be to simply pay less attention. Those who had had gone to sleep on April Fools’ Day and checked their investment portfolio a month later might have assumed the market had been relatively calm. For investors who spent the month tracking daily returns, the experience likely felt far more nerve-racking.

A word on the supposed AI bubble

Much has been written about whether the world is currently in an AI ‘bubble’. Some argue that valuations are detached from reality and that a reckoning is inevitable. Others insist that the technology will justify current prices and more. Both views may ultimately prove right in different ways, at different times.

In one view of markets, prices always reflect all known information, and what looks like excess is simply the rational pricing of uncertain future cash flows. In another, human behaviour and sentiment periodically push prices too far in either direction. In practice, these are just models, a helpful but simplified version of the truth.

The uncomfortable reality is that only with hindsight will anyone know whether the world is currently living through an AI bubble, let alone when it may pop.

The enduring lesson

Market outcomes will be shaped by events that cannot be forecasted with confidence. Against this backdrop, the most robust response remains unchanged: maintain broad diversification, accept uncertainty as the price of long‑term returns, and remain disciplined when headlines are most unsettling.

“If you love everything in your portfolio, you’re not diversified enough.“

Dan Bortolotti speaking on The Rational Reminder Podcast, January 1, 2026

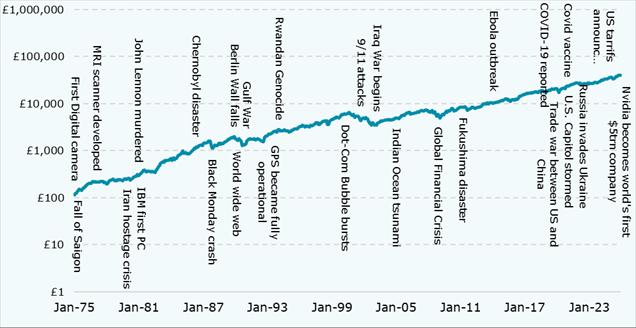

Figure 3: Stock markets are resilient to world events over the long term

Source: Albion Strategic Consulting. Albion World Equity Index (https://smartersuccess.net/indices). Jan-75 to Dec-25. Monthly returns in GBP.

When attention is focused on tough times, it may not be a bad idea to spend time away from headlines altogether, or search for coverage from outlets focused on positive world events and human progress[1].

All of us at BpH wish you a happy, healthy and prosperous New Year.

Important notes

This article is distributed for educational purposes for UK residents. It should not be considered investment advice, an offer of any security for sale nor a recommendation of any particular security, strategy, platform or investment product. This article contains the opinions of the author but not necessarily the Firm. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Products referred to in this document

Where specific products are referred to in this document, it is solely to provide educational insight into the topic being discussed. Any analysis undertaken does not represent due diligence on or recommendation of any product under any circumstances and should not be construed as such.

Endnote

Representative funds used:

UK equity market: iShares UK Equity Index (UK) D Acc

Global developed stock markets: Fidelity Index World P Acc

Emerging markets: Vanguard Em Mkts Stk Idx £ Acc

Global commercial property: HSBC FTSE EPRA/NAREIT Developed ETF

Short-term global bonds: Vanguard Glb S/T Bd Idx £ H Acc

60/40 portfolio: 40% Short-term global bonds, 50% Global developed stock markets, 5% Emerging markets, 5% Global commercial property

This does not constitute a recommendation – for illustrative purposes only.

[1] For example, Good News, Inspiring, Positive Stories – Good News Network

Share this content