We have a systematic, globally diversified, low cost way of investing which is designed to give you the best chance of a successful investment outcome.

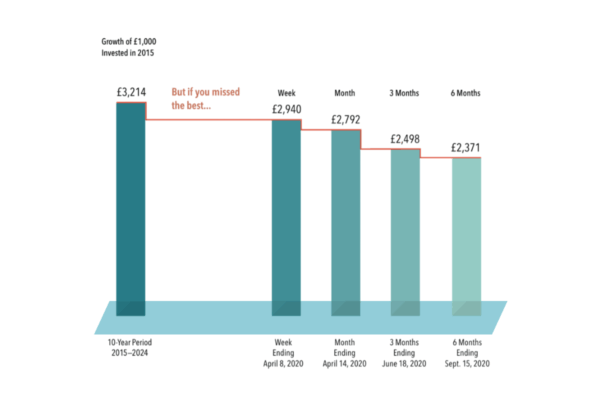

Systematic describes our objective and disciplined approach to investing with a goal to capture the asset returns over the longer term rather than to try and beat the market in the shorter term.

We do this by recommending a strategy of global diversification, careful asset allocation and disciplined rebalancing. This means less buying and selling, which in turn reduces the cost of investing.

We don’t provide financial forecasts

We believe this is impossible.

We believe you can’t beat the market

So you shouldn’t try.

We believe it is better to invest in the whole market

Not today’s best performing part.

We aim to

- Give you a healthy rate of return without exposing you to any unnecessary risk or cost and,

- Minimise the amount you have to pay in tax.

We begin by identifying your tolerance for risk

Taking into account

- Your specific liquidity needs

- Your income requirements

- Your time horizons

- Any unique tax considerations

- The minimum return required as determined by your cash flow model.

We design your portfolio

We agree the most appropriate combination of institutional investments to achieve your objectives at the minimum risk, tax and cost to you.

Then we will provide you with a personal investment strategy setting out how your money will be invested and reviewed.