Market crises through a long-term lens

During good times in markets, headlines can cause investors to wonder whether such highs signal an impending downturn or poor future returns. However, history suggests that this fear, whilst common, is often misplaced.

Markets reaching an all-time high is not unusual, in fact it happens regularly. This is a reflection of investors being rewarded for taking on the risks of stock ownership, rather than a warning sign.

Since 1926, the US market has ended on a new high in about one out of every six weeks

Dimensional Fund Advisors[1]

This is not to say that markets will not decline; they do and can fall with disconcerting speed and magnitude. However, no one possesses the ability to consistently and accurately time the market. Attempting to predict when a high will turn into a decline is not only extremely difficult, getting it wrong can have significant implications for an investor’s financial plan.

Timing the market is not as simple as ‘buy low sell high’. There are two key decisions:

- When to sell; and

- When to buy back in.

Both come with material challenges.

Selling

Those who sell on a market peak or after a slight wobble have to contend with the fact that the market may continue to peak for many months or even years afterwards, potentially missing out on valuable growth. Further, buying back in later at more expensive prices may prove expensive by comparison. There is of course the worst-case scenario, in which the market stays defiantly high for so long the investor buys back in, only for the market to crash soon after.

Buying

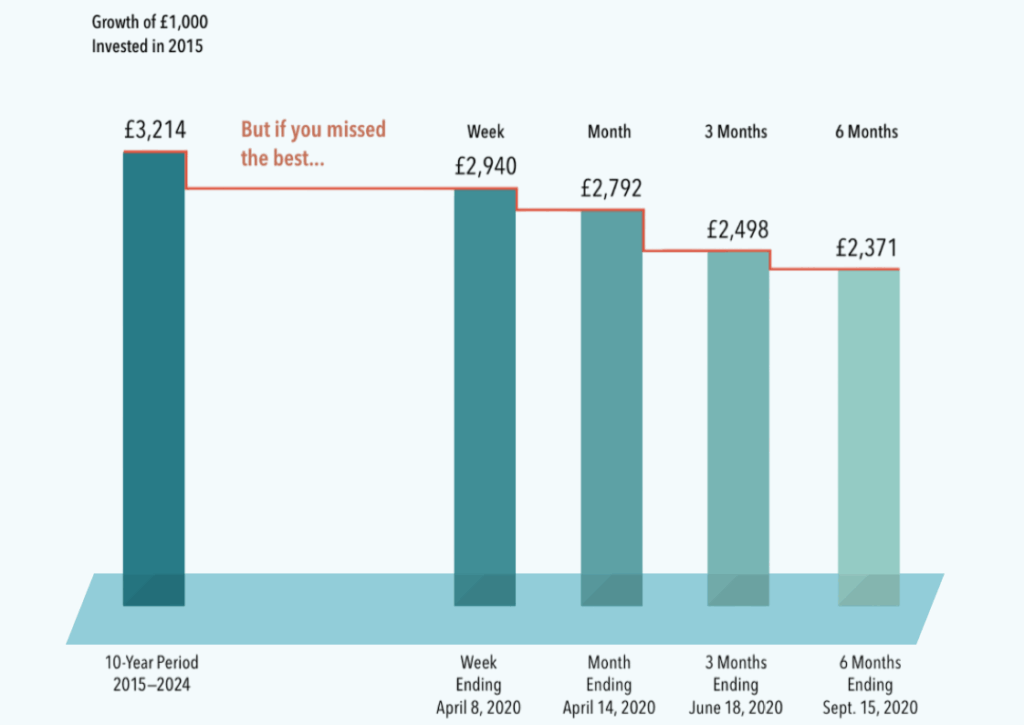

Some of the market’s best days happen when bouncing back after a crash, holding out for markets to hit the same lows again can be immensely costly if they never do. Further, crashes can happen in two or more waves, making it extremely difficult to find an optimal reentry point. The following chart considers missing the best days in the markets.

Source: Dimensional Fund Advisers

Either way, attempts to time the market are not investing, it is high-stakes gambling, it causes unnecessary stress and is no way to treat one’s hard-earned savings or to risk financial objectives. A solid financial plan is built using reams of historical data and analysis to give the investor the best chance of success in achieving their goals over the long term, it is not worth risking whether due to fear or to eke out extra returns.

Time in the Market, Not Timing the Market

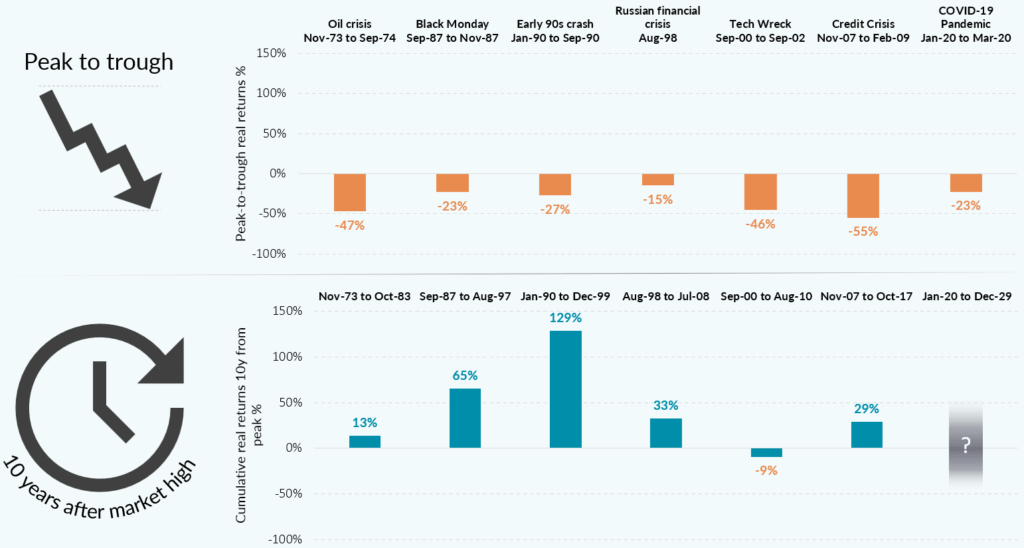

One tool investors possess to protect investments against declines is time. To provide context, the chart below illustrates seven major stock market crises over the past century, showing the performance from peak to trough and that – in most cases – ten years later portfolios had recovered and grown in real (inflation-adjusted) terms. The fact that not all periods show a positive outcome over the ten-year term illustrates the lack of any implicit guarantees, this risk is why investors are typically rewarded handsomely in the long run. This eventuality is also one reason that, in practicality, it is sensible for many investors to balance volatile stockholdings with other asset classes like bonds and property investments, which can even out the dips.

Figure 1: Market crises look different through a long-term lens

Source: Albion Strategic Consulting. Data source: Albion World Stock Market Index © https://smartersuccess.net/indices. In USD, after inflation.

Markets are inherently unpredictable. On any given day, they are roughly as likely to rise as they are to fall. Over five-year holding periods, returns of stock markets have fallen short of inflation 1-in-5 times[2] – a reminder of the risk that comes with investing.

However, the longer an investment is held, the greater the opportunity for expected outcomes to prevail. The investing journey comes with large steps forward and back – that is the nature of the game – but those that can look at investing through a long-term lens can cut through the headlines and take comfort that stock markets are doing the heavy lifting for them in the long run.

Important notes

This article is distributed for educational purposes for UK residents. It should not be considered investment advice, an offer of any security for sale nor a recommendation of any particular security, strategy, platform or investment product. This article contains the opinions of the author but not necessarily the Firm. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is no guide to future performance and investments can fall as well as rise.

[1] Dimensional Fund Advisors (August 2025), ‘The Informed Investor’ podcast, ep. 6

[2] Data source: Albion World Stock Market Index © https://smartersuccess.net/indices. In USD, after inflation. Jul-26 to Dec-24.

Buy-to-Let vs Pensions: Which Is the Better Retirement Strategy?

The British public have had a long and sometimes unhealthy obsession with property. For many, bricks and mortar mean much more than a place to live or raise a family, housing has doubled up as a retirement plan, a nest egg, and even a springboard to borrow against for future ventures. Many of those with

The US Election- Presidents Change, Markets Remain

Another four years have flown by, and here we are again, Another US election has been decided and Donald Trump has secured a historic win. He is only the second president to win back the White House after losing a presidential record, the last time was in 1892. The U.S. president is often considered one

FOMO, Risk and Regret? Diversification in the age of the Magnificent Seven

This article was published in August 2024 There is no denying it, the US market has done very well as of late. However, a look behind the headline figures shows us things aren’t so simple. It can be seen that much of the US market’s strong returns can largely be explained by just a handful

Ancient History, Modern Lessons- A Story From The Recent GAIA Conference

In October 2023, I attended my last conference as Chair of the Global Association of Independent Advisors (GAIA) in Stockholm. It is always great to meet with the leaders of likeminded firms across the globe and find out what they are doing to improve their service to clients. This year’s overarching theme was about technology

Behind the Wizard’s Curtain- why the financial media’s claims can’t always be trusted

This article was published in June 2023 These aphorisms highlight a simple but important truth that is more relevant and profound today than ever: “Facts are stubborn things, but statistics are pliable.” “Statistics do not speak for themselves.” These days the sheer abundance of data and information available to us can be dizzying and overwhelming.

New year, new narratives- no one can predict the unpredictable

This article was published in April 2023 The below is an abridged version of a ‘BpH insight’ we produced for our clients. Send us an email here if you would like to read the full version. Each year, investors face a barrage of commentary and speculation from the financial press about which stock, sector or

Inflation, Cash and the Purpose of Investing

After over a decade of reasonably stable inflation, it has once again shot back into the headlines. Not only are prices increasing across the board, but essentials like essentials like food, fuel and energy are experiencing some of the biggest increases, hurting the bottom line of many households. The treasury’s decision to freeze personal tax

Thrilling Tales and Simple Truths: the art of wilful ignorance in the world of investing.

The story of Ignaz Semmelweis is both a marvel and a tragedy. His work was a crucial step in forming the modern theory of disease, saving countless lives. However, at the time, his findings barely made a ripple in the medical world. Many lives which could have been saved were condemned by the seemingly voluntary

The Problem With Probabilities

What influences our perspective on risk? In finance, risk is often determined by calculations based on historical data and empirical observations. However, the way risks are manifested in our heads is far different from how a computer will interpret them. If you have ever been fortunate enough to swim in oceans around the Caribbean or

Becoming a successful investor [video series]

In this series of short videos, Simon Brown, partner and Chartered Financial Planner, explains what all investors should know to become successful. This includes the risks, behaviours and opportunities that are important to take into account when investing.

Managing Risk and Reinvesting Profits in Volatile Markets

Who could have anticipated how markets behaved in the last year? It’s a question that comes up time and time again in the world of investing. Today is no different. Who would have predicted a pandemic would cause one of the sharpest equity market declines in recorded history? Who would then have been brave enough

What does the GameStop Squeeze Mean For the Future of Investing?

This article was published in February 2021 Do investors need to take note? Early into the new year, the share price of GameStop began to edge upwards. The brick-and-mortar video game retailer was widely thought to be a relic of a former age. However, it had caught the attention of millions retail investors using Robinhood

You should have no interest in interest, but plenty in the power of compound returns.

Published on January 2021 Albert Einstein’s wisdom didn’t stop at physics. In a lesser-known quote he called compound interest the ‘eighth wonder of the world’. For those that understand compounding, the reason why is obvious. However, we can’t all be Einstein. Compounding is difficult for most of us humans to wrap our head around intuitively.

The UK Has Seen the Biggest Quarterly Fall in Dividends on Record, Here’s Why Accomplished Investors Shouldn’t Worry

30/10/2020 In the headlines, the news looks bad, but this is precisely the eventuality that a sensible investor should be prepared for. At BpH Wealth we follow the evidence, which suggests that relying on dividends in your portfolio has never been a good strategy, this is just the most recent example of why. In times